Using QR Codes for Payments

In 2025, the market size of QR code transactions is expected to reach $2.71 billion. That’s a staggering figure, reflecting the growing demand for quick, contactless, and secure payment solutions. Whether you’re a small business owner or a consumer, QR codes for payments make everything simple—no cash, no cards, just a scan.

So, how can businesses take advantage of this trend? In this article, we’ll break down how QR code for payments work, their key benefits, and how you can use them to enhance both customer experience and business operations.

How do QR code payments work?

QR code payments are an easy and secure way to pay using your smartphone. Whether it’s a QR payment or a QR code for payment, this method simplifies transactions for both consumers and businesses. Here’s a quick breakdown of how QR code payments work:

- A QR code stores payment information: This can include the recipient’s account details, a specific payment link, or transaction-related information like a fixed amount

- You scan the QR code: Use your phone’s camera or a payment app (such as Google Pay, Apple Pay, or a banking app) to scan the code. Modern smartphones can detect QR codes instantly without additional software, even for creative designs like circle QR codes or transparent QR code

- The scan directs you to a secure payment page: Once scanned, the QR code either opens a payment portal or pre-fills the recipient’s details, ensuring you don’t need to manually input any information

- You confirm and authorise the payment: Enter the payment amount (if not pre-set) and confirm the transaction using a PIN, fingerprint, or facial recognition for added security

- Merchants can generate QR codes easily: QR codes can be displayed digitally on screens, printed on menus, receipts, or posters, making it accessible to any business, large or small

QR payments are a simple, cashless, and contactless way to pay, perfect for quick and hassle-free transactions.

Benefits of using QR codes for payments

QR codes offer several advantages that make payments quicker, safer, and more convenient. Here are the four main benefits:

Ease of use

QR code payments are simple. All you need is a smartphone with a camera and a payment app—no need to carry cash or cards. For users, it’s as simple as scanning a code, while merchants can display a printed or digital QR code without requiring expensive equipment. With tools like a QR code generator or PDF QR code generators, businesses can create payment QR codes in seconds and share them digitally or in print.

Cost-effective for merchants

For businesses, QR codes are a highly budget-friendly way to accept digital payments, especially for small and medium-sized enterprises. Unlike traditional payment systems that require expensive card readers, payment terminals, or hardware, QR codes can be generated for free or at a very low cost.

Merchants can use dynamic QR codes to update payment details without needing to regenerate the code, saving time and reducing waste. They can also explore options like printing QR codes for display on receipts, invoices, menus, or posters—an inexpensive and effective way to streamline payments. Tools such as link QR code generators allow businesses to link payment portals directly, ensuring a smooth user experience.

Enhanced security

QR code payments come with built-in security features. Data in the QR code is encrypted, and payments often require user authentication through PINs or biometrics. This reduces the chances of fraud or unauthorised transactions, making them safer for both users and businesses. With options like a payment QR code or a scan and pay QR code, users can enjoy secure, hassle-free transactions.

Fast and efficient transactions

QR codes make transactions quick and seamless. With a scan to pay QR code, there’s no waiting for card authorisation or handling cash—simply scan, confirm, and pay. This speed is particularly useful in high-traffic areas like cafes, shops, or public transport, where every second counts.

How businesses can use QR codes

QR codes can be used in various ways to enhance customer experience and simplify operations. Here are a few key use cases:

In-store payments

Businesses can display QR codes at checkout counters for quick, contactless payments. Customers simply scan the code using their payment app, enter the amount, and confirm the transaction. This speeds up the payment process and reduces queues, offering a hassle-free experience.

Examples:

- A coffee shop places a QR code at the counter for customers to pay using Apple Pay or Google Pay, eliminating the need for cash or cards.

- A clothing store prints a QR code on the billing account so customers can scan it and pay directly from their banking app, ensuring fast checkout.

Online and delivery payments

Merchants can include QR codes on invoices, receipts, or delivery packages, allowing customers to pay directly from their smartphones. This is especially useful for businesses offering home delivery or remote services, providing a seamless payment option without the need for cash or card readers.

For example, food delivery service includes a QR code on the delivery receipt. Customers scan it with their banking app to instantly pay for the meal, avoiding cash-on-delivery delays.

Promotional offers and discounts

QR codes can also be used to engage customers with promotions. Businesses can display codes in-store or on marketing materials that link to exclusive discounts, loyalty programmes, or special deals, encouraging customer interaction and repeat purchases.

For example, a retail store places a QR code on posters and flyers that customers can scan to access a 20% discount on their next purchase or join a loyalty programme.

Ticketing and event management

Event organisers can use QR codes for ticket payments and verification. Customers can scan a code to purchase tickets or present the code at entry for quick check-ins, reducing the need for physical tickets and streamlining the entire process.

For example, a music festival sends e-tickets with QR codes. Attendees simply show their QR code at the gate for scanning, ensuring quick and efficient entry.

How to generate QR codes for payments

Here is a step-by-step guide on how to create QR code for payments:

- Sign up for a QR code generator: Create an account on Mobiqode that supports dynamic QR codes

- Choose the QR code type: Select website as the QR code type. Input copy/paste your exact payment link.

- Customise the QR code: Adjust the colours, patterns, and styles while keeping it scannable. Make sure it aligns with your branding while remaining user-friendly.

- Download in your preferred format: Export the QR code in high-quality formats like PNG, SVG, or PDF for easy use across printed materials, screens, and mobile devices.

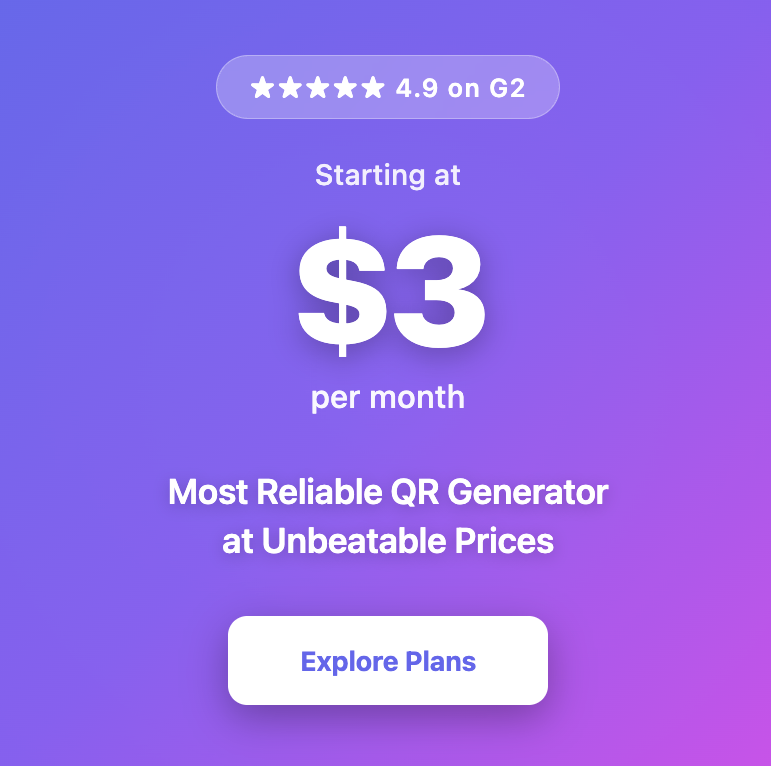

Starting collecting payments with mobiQode

QR code payments are fast, secure. But to fully unlock their potential, businesses need more than just a static QR code.That’s where Mobiqode comes in. As a dynamic QR code generator built specifically for businesses, Mobiqode lets you create, customize, and track payment QR codes that can be updated without reprinting. Whether you’re managing multiple locations, rotating promotions, or tracking campaign performance, Mobiqode puts you in control of your business.

QR codes are the bridge between the physical and digital world. We’re making it simple for everyone to create, share, and connect.

— Ankita Saraswat, Founder of mobiQode

Ready to Create Your QR Code?

Choose from our suite of specialized QR code generators